abolishment of gst malaysia

RM 5000 RM 1000 RM 4000 Profit Margin. The GST was introduced in 2015 before the then government decided to abolish the tax system in 2018.

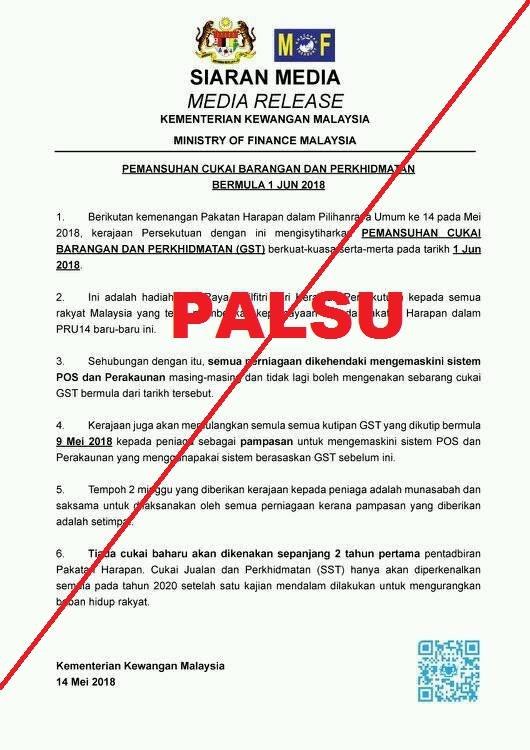

Did Ministry Of Finance Announce The Abolishment Of Gst By 1 June 2018 Soyacincau

KUALA LUMPUR May 14 Reuters - Malaysia has not yet set a date for the abolishment of the Goods and Services tax GST the finance ministry said in a.

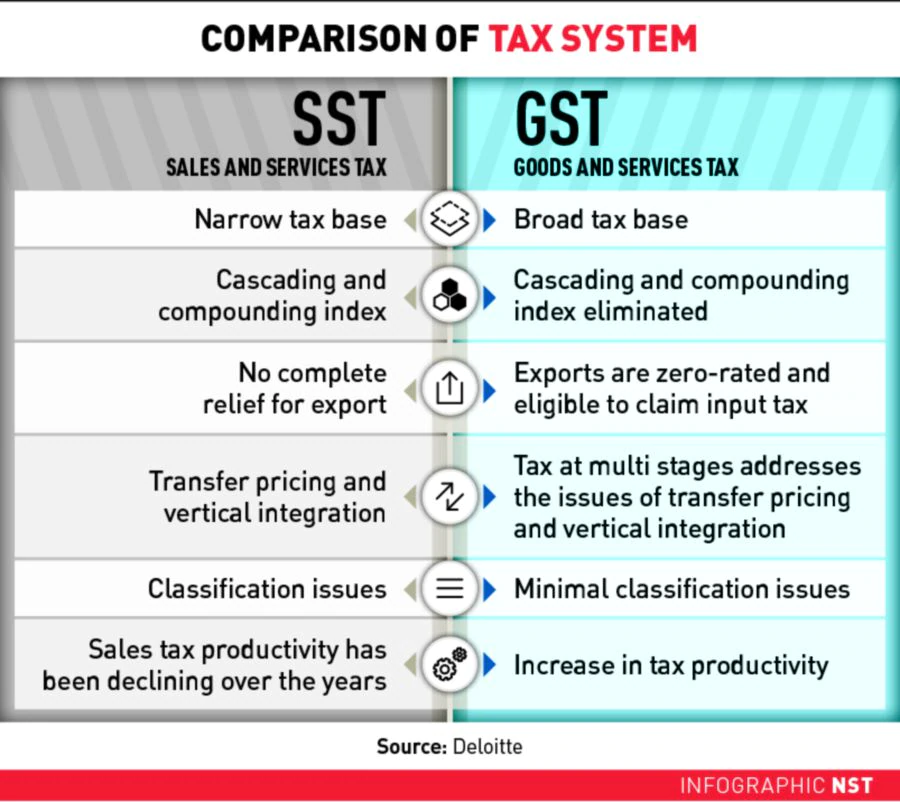

. Judging from the data GST collection was RM44 billion a year and the total during its implementation was RM1331 billion while SST collection was just RM21 billion annually he said when winding up the debate on the Sales Tax Amendment Bill 2020 in. On 31 August 2018 GST was abolished and SST was implemented on 1 September 2018. Its chairman Tun Dr Mahathir Mohamad said the Sales and Services Tax SST will be reinstated to replace the GST.

Numerous rules and exception to the rules eg. The government has announced that the GST will be replaced and abolished by the SST on the 1st of September. For more information regarding the change and guide please refer to.

Malaysia GST Reduced to Zero What is GST. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The previous governments decision to abolish the Goods and Services Tax GST has to some extent affected the countrys revenue said Deputy Finance Minister I Datuk.

Pakatan Harapan will keep its promise to abolish the Goods and Services Tax GST after forming the Federal government. What is Sales and Service Tax. KUALA LUMPUR - Malaysias goods and services tax GST will be reduced from 6 per cent to zero per cent from June 1 the Finance Ministry said on Wednesday May 16.

Their sales price of a product to their retailers is set at RM 5300 where RM 300 is GST payable to the Malaysian government. Malaysias six percent GST was introduced on April 1 2015 to replace the SST. Overview of Goods and Services Tax GST in Malaysia The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

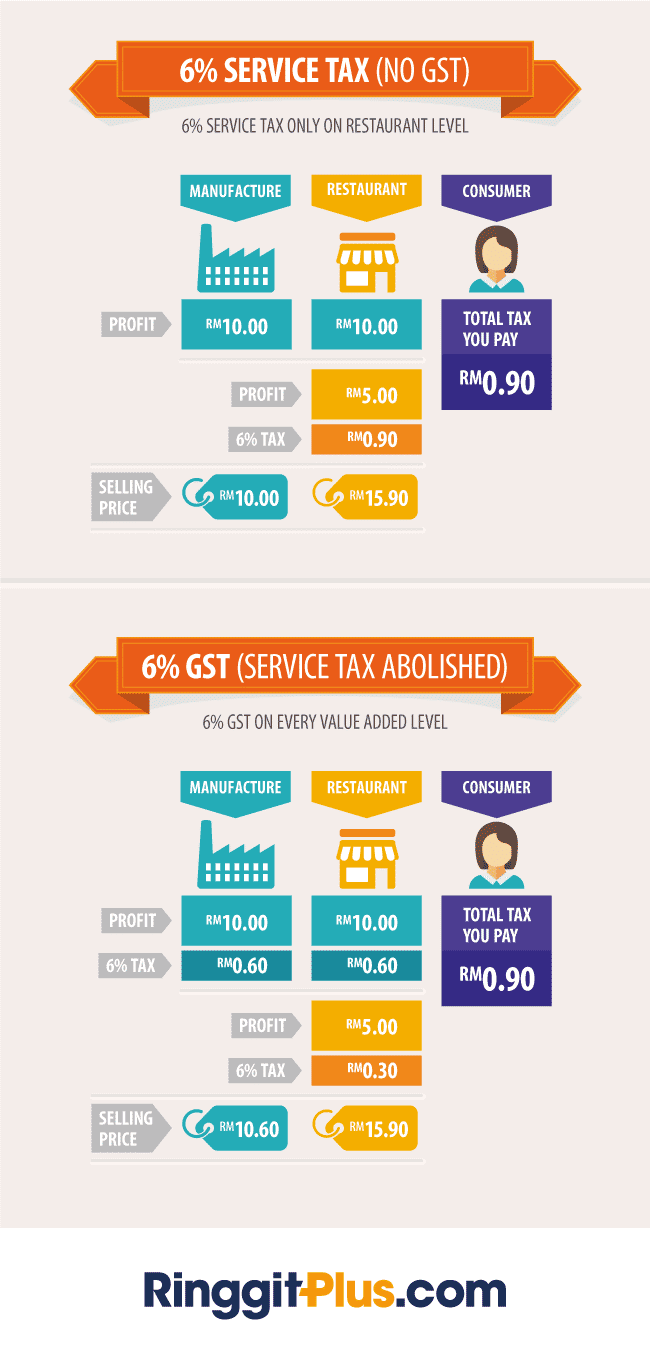

Pakatan in its quest to wrest Putrajaya said the tax had caused the. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The objective of abolishing the GST was to put more purchasing power in the hands of the Malaysian people especially the lower- to middle-income earners.

The election manifesto of the new Government had proposed to implement these reforms ie abolish GST and replace it with SST within 100 daysof coming into power. It is unclear at this stage as to whether 100 days is still the intended time-frame and the Ministry of Finance has confirmed on 14 May 2018 that no date has been set yet. We dont need it.

Malaysia is not the first country in the world to abolish GST Value Added Tax VAT as countries such as Malta Ghana Belize Grenada and Vietnam have done so in the past for various reasons. The unpopular consumption tax was abolished. Five Legal Issues on GST at 0.

RM 4000 RM 5000 x 100 80 Net GST Payable. Many people believed that GST increased living costs since it was implemented. This is because as with all tax policies the removal of the GST is dependent on our parliament repealing the GST Act of 2014 before it can be fully abolished.

The existing standard rate for GST effective from 1 April 2015 is 6. This study concluded that the most likely reasons for the abolishment of GST in Malaysia are. Interestingly these countries have since reintroduced GST VAT some years later after the abolishment.

Judging from the data GST collection was RM44 billion a year and the total during its implementation was RM1331 billion while SST collection was just RM21 billion annually he said when winding up the debate on the Sales Tax Amendment Bill 2020 in. A drop in the barisan nasional government after the. The GST was introduced in 2015 before the then government decided to abolish the tax system in 2018.

On 16 May 2018 the government announced that the Goods and Services Tax GST is to be set at 0 effective 1 June 2018 see Goods and Services Tax Rate of Tax Amendment Order 2018 dated 16 May. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. KUALA LUMPUR BERNAMA - Malaysias Parliament on Wednesday Aug 8 repealed the Goods and Services Tax Act 2014 after its third reading in the House.

Many domestically consumed items such as fresh. The existing standard rate for GST effective from 1 April 2015 is 6. Khong Siong Sie and Kailash Kalaiarasu highlight the legal nuances behind the abolishment of GST.

35 tax codes gifts rules 21-day rules frequent changes of GST rulings and guidelines GST computations that were too difficult for mixed supply and process of GST refund that were onerous and lengthy. Whether Malaysia will join the.

A Guide To Gst In Malaysia How Does It Affect Me

Things You Need To Know About Malaysia Gst Abolishment

Letter That Gst To Be Abolished In June Is Fake

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

Did Ministry Of Finance Announce The Abolishment Of Gst By 1 June 2018 Soyacincau

Gst In Malaysia Will It Return After Being Abolished In 2018

A Survey Found That Over 70 Per Cent Of Goods Prices Went Down After Gst Abolishment Rojakdaily

Was Ph Right To Abolish Gst The Edge Markets

How Is Malaysia Sst Different From Gst

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

New Car Prices In Malaysia Following Abolishment Of Goods Service Tax Automology Automotive Logy The Study Of

Shah Yuni Gst In Malaysia How The Goods And Services Tax Affects You

A Guide To Gst In Malaysia How Does It Affect Me

A Guide To Gst In Malaysia How Does It Affect Me

Gst In Malaysia Will It Return After Being Abolished In 2018

An Introduction To Malaysian Gst Asean Business News

0 Response to "abolishment of gst malaysia"

Post a Comment